NAA Inflation Tracker: March 2022

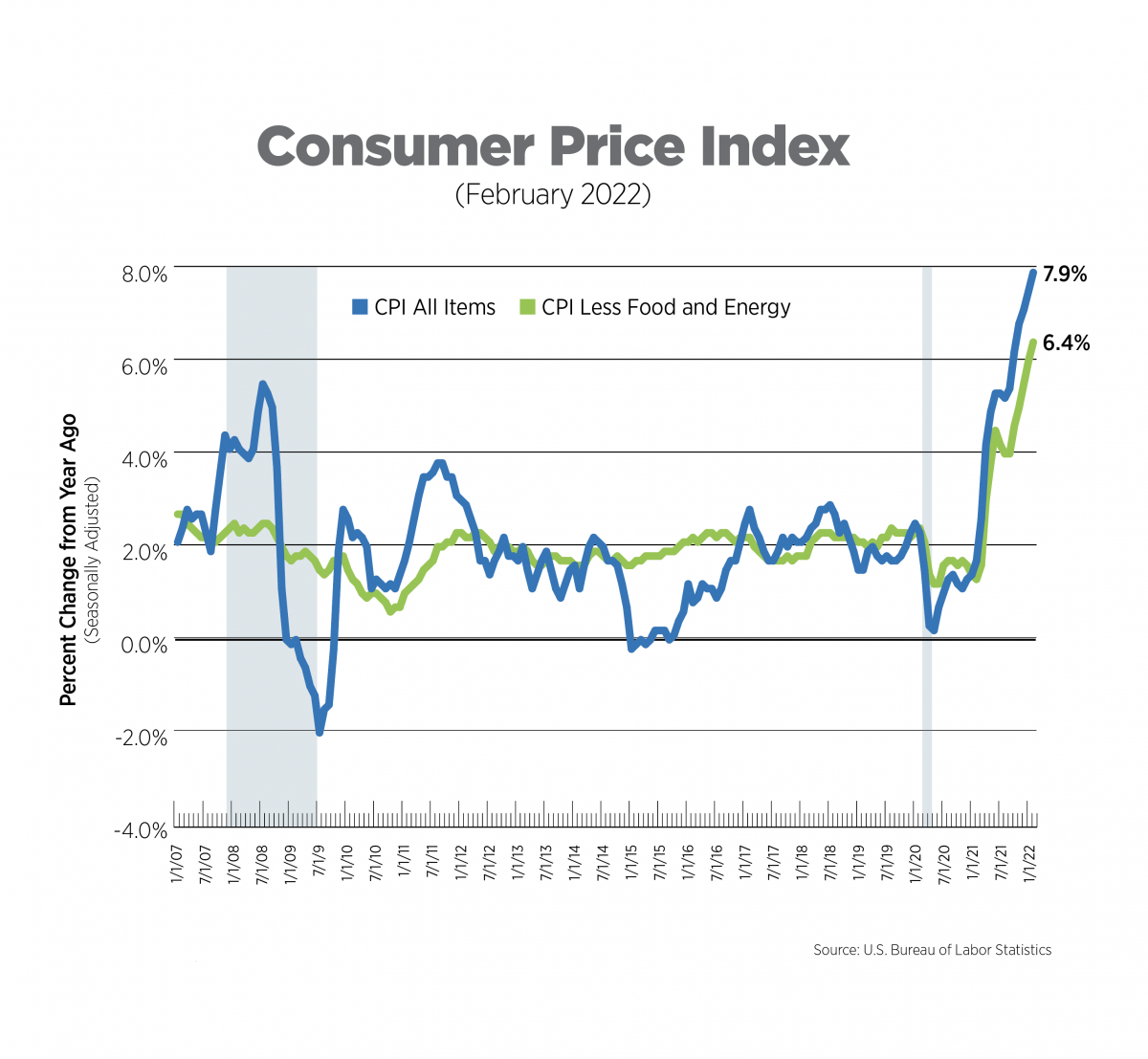

The Consumer Price Index (CPI) increased 7.9% year-over-year while core CPI (excluding food and energy) increased 6.4%, both new 40-year highs. On a monthly basis, food prices increased 1.0%, the highest gain since the onset of the pandemic in April 2020. After easing for the past two months, energy prices spiked 3.5%. Excluding food and energy, airline fares were up 5.2%, the highest gain since May of last year. There is evidence that some supply chain pressures were beginning to ease with prices for used cars & trucks decreasing while those for new vehicles experienced the lowest increase in nearly a year.

Financial and commodities markets were sent into a tailspin after the Russian invasion of Ukraine on February 24, just a few days before the end of the month. Thus, the full weight of the invasion and the global community’s response will not be evident in CPI until the March release. Whatever supply chain relief may have been materializing will be erased in the coming months.

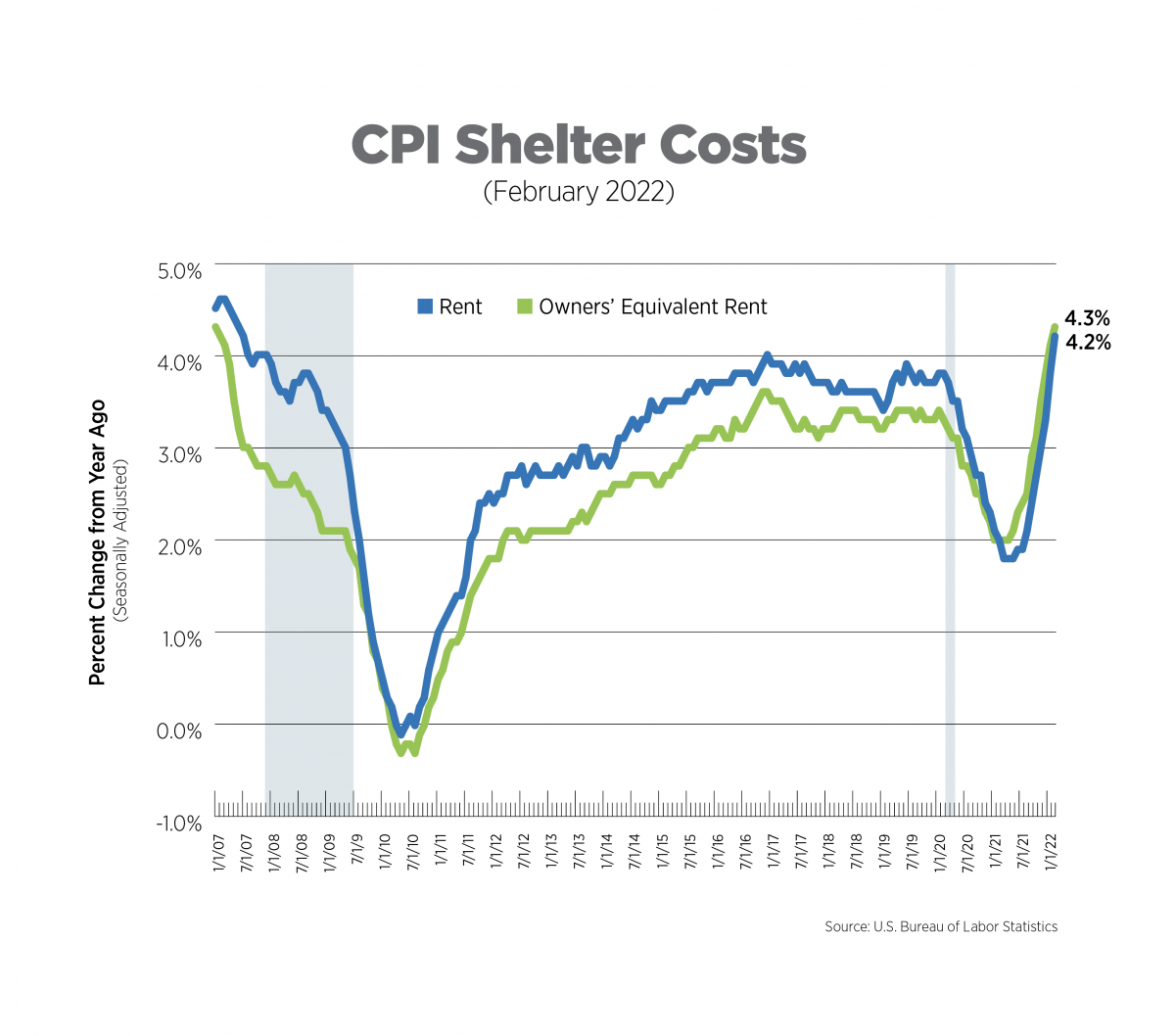

CPI for Housing, February 2022

The CPI includes two measures for shelter costs: owners’ equivalent rent and rent of primary residence, both of which are self-reported. Together, they comprise about one-third of CPI. Owners’ equivalent rent, which is the price owner-occupiers think they could attain if they rented their homes, rose 4.3%, the highest rate in 15 years. Rent of primary residence, which had been lagging owners’ equivalent rent in recent months, increased by 4.2% year-over-year, the highest rate since July 2007.

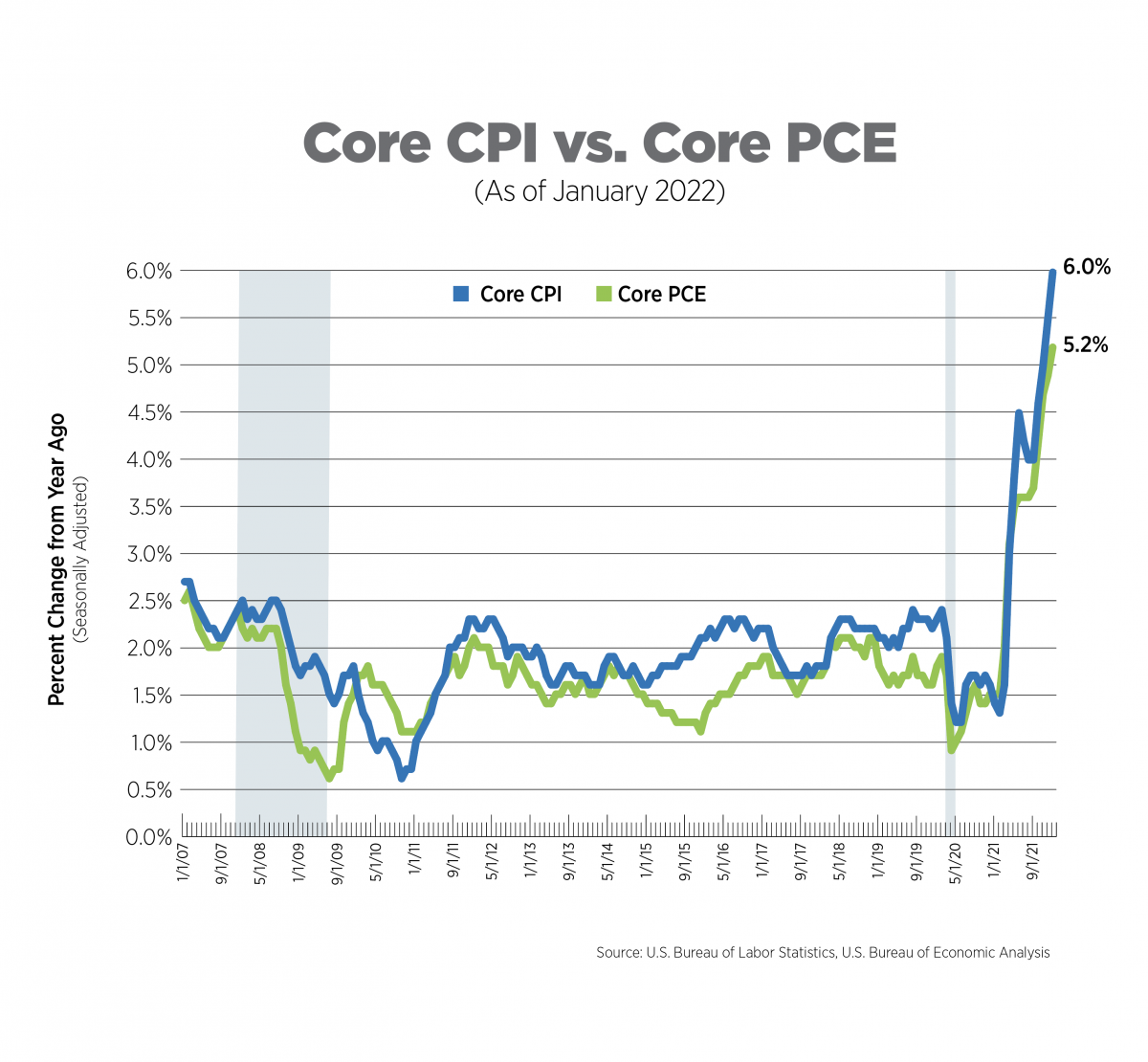

Alternative Measures of Inflation, January 2022

The core Personal Consumption Expenditures (PCE) Index is the measure of inflation the Federal Reserve Bank uses in its policy decisions. It is produced by the Bureau of Economic Analysis and uses different formulas, different weights and has a different scope compared to the Bureau of Labor Statistics’ (BLS) CPI.

Headline PCE rose 6.1% year-over-year while core PCE increased 5.2%, both at the highest levels since the early 1980s and higher than many analysts had expected. While there had been some speculation that the Fed might delay its policy actions due to the tumult caused by the Russian invasion of Ukraine, Chair Powell indicated otherwise in his testimony to Congress last week, stating he would support a quarter-point rate increase this month.

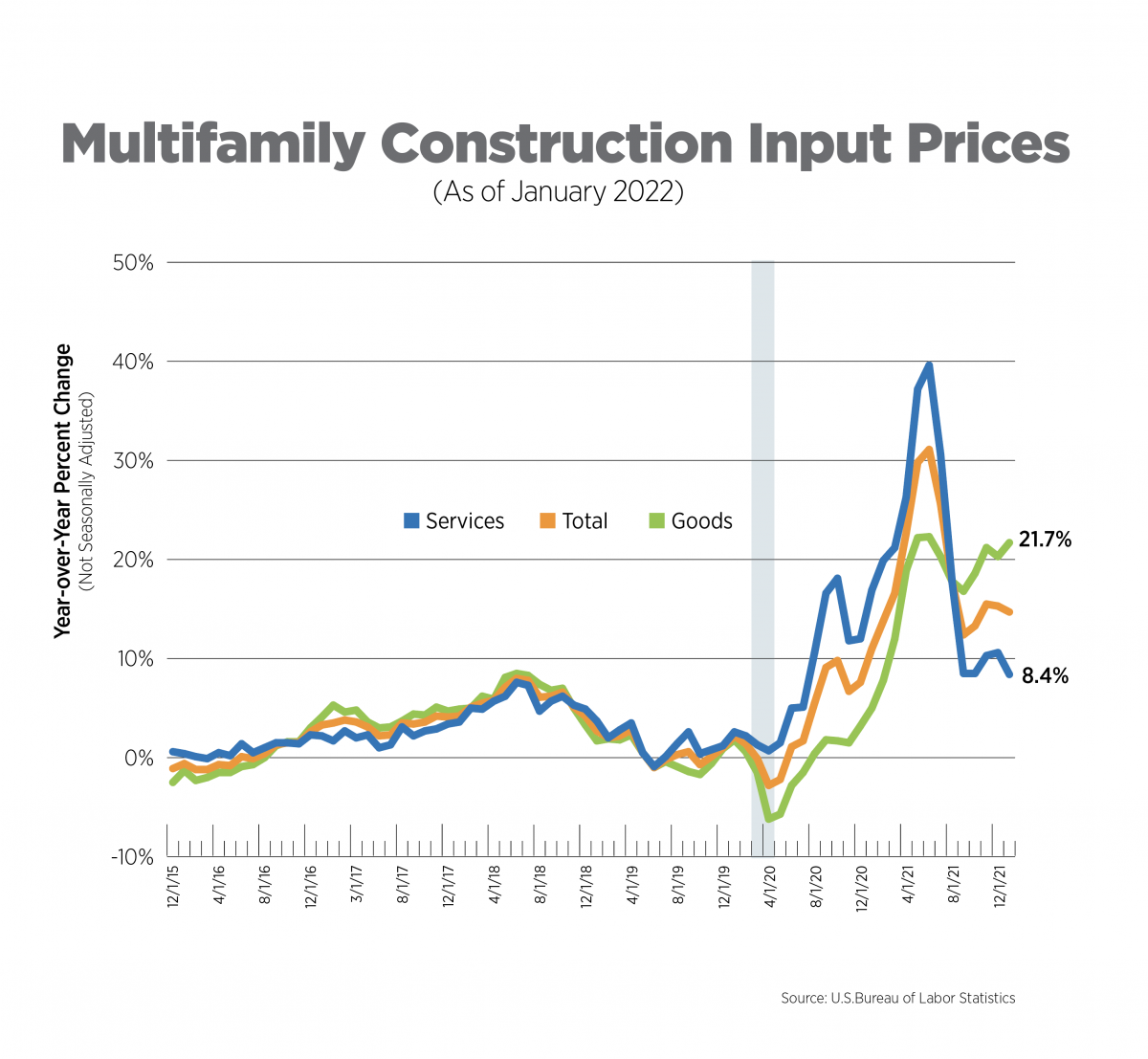

Multifamily Construction Input Prices, January 2022

The Producer Price Index includes a compilation of prices which measures all inputs to multifamily construction. For goods, this means lumber, gypsum, steel and other building materials. For services, this includes financial, legal, engineering, architectural and transportation services, among others.

On a year-over-year basis, services prices have begun to moderate in the past few months, although it’s important to note that prices for construction services were running up ahead of goods in 2021, resulting in some base effects. Despite a temporary reprieve for some materials prices, increases have been north of 20% for the past 3 months.

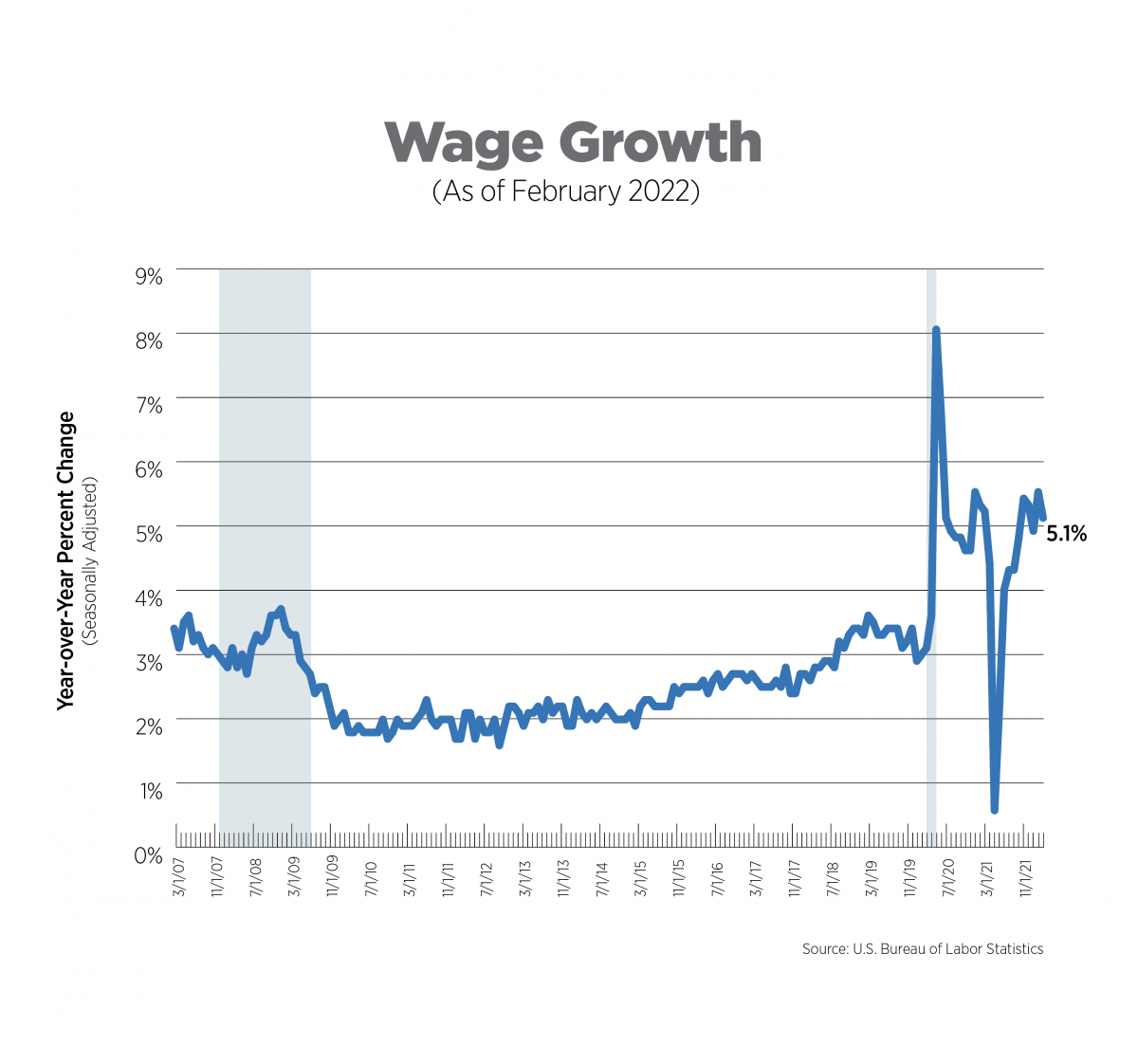

Wage Growth, February 2022

Wage growth, as measured by average hourly earnings, increased 5.1% over the year, but was essentially flat on a monthly basis. Inflation has now outpaced wage growth for the past eleven months. Leisure/hospitality wages increased 11.2% year-over-year while transportation/warehousing, retail trade, professional/business services and education/health all increased at a faster pace compared to the U.S. average.

What to Watch in the Next Month

The Fed meets on March 15-16 and is expected to announce that it is moving forward in tightening monetary policy, to include a quarter-point rate increase. More aggressive action is not likely coming out of the March meeting given the economic shocks caused by the Russian invasion of Ukraine but may well be on the horizon in the near-term.

The invasion has quashed all hopes that inflation would begin to ease in 2022. Although Russian oil grabs much of the headlines, the contribution of both countries to non-energy commodities and the global food supply cannot be overlooked. With food and beverages comprising 14.3% of CPI, energy another 7.3%, household fuels/utilities, 4.6% and gas, 3.8%, upward pressures on prices will persist for months to come.

Next Tracker: March 10, 2022